In an age where the app market is flourishing, choosing the right app to track mileage as a small business owner or an independent contractor is more important now than ever before. There are many mileage trackers and add ons available out there, and most can be downloaded from Google Play and App Store with relative ease as both Apple devices and Android technology can run the majority of these apps. Free versions abound, but if you really want to optimize your tax deductions – you need a paid app. Today we will be looking at the best mileage tracker apps from a features point of view, examining an overview of the market.

The Kind of Features You Will Need

Table of Contents

Before we get into a wider overview of the market and what various apps offer, it’s crucial that we examine the features that are most important when it comes to tracking mileage effectively.

A Variety of Auto Tracking Modes

Auto tracking is a paramount feature of any piece of mileage tracking software. Most competent software providers on the market offer vehicle movement tracking – a system whereby your phone detects that you have left your vehicle and thus that your trip has ended; you need only to turn the feature on and your phone will detect when you have gotten out of your vehicle, consequently ending the trip.

Additional auto tracking modes are available from some providers, some of which we’ll be looking at today. These include Bluetooth and Plug-N-Go methods, which, according to the expert opinion of some, are more reliable. In most cases vehicle movement monitoring gets the job done – but it’s certainly great to have other options you can test and see what works best for you.

Manual Trip Recording

While seemingly mundane on its face, one of the market’s most popular providers, MileIQ, does not offer this feature. This is also true for many other companies – perhaps the idea being that once one has auto-tracking, there’s simply no need to use anything else. Unfortunately, this is far from the case in reality. That’s because whether you’re using a mileage tracker or another type of accounting software that allows you to track mileage, any app is capable of making mistakes. If you should ever find the IRS knocking on your door looking for an audit, you want to make sure you’re covered on multiple bases.

Part of the benefit of manual trip recording includes the ability to edit your trips – or, as is the case with MileageWise – to reconstruct entire logs retrospectively. More on this provider soon – it’s quite amazing what some of the newer companies in this app space have been able to bring to bear, and MileageWise is a newer player in the market making waves right now.

An In-Built IRS Auditor

We’ve already mentioned the potential for an IRS audit, but it’s worth a little more focus. Getting audited by the IRS isn’t something anyone should take lightly – a fine can result in a serious hit to your bank account. Luckily, MileageWise’s new app also has you covered here. They offer a built-in IRS auditor which reviews your mileage logs in the context of your odometer readings – examining and correcting 70 logical conflicts which could make your log unsatisfactory in the face of an IRS audit. It seems that the company really means it when they call themselves IRS-Proof. Sadly, no other players on the market offer this feature – most offer a more simple mileage tracker.

A Top-Down View of The Mileage Tracker Market

Now let’s get to our main question here: What’s the best mileage tracker app on the market?

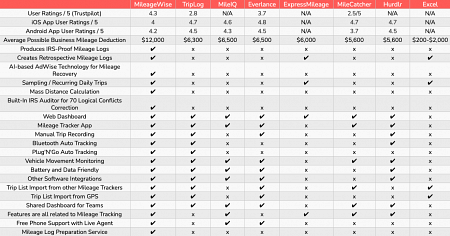

Below you can see the vast majority of companies who produce mileage tracking software, though some, like Hurdlr, are more focused on tracking business expenses in general.

If this chart makes one thing clear, it’s that popularity doesn’t always equate to competence. It’s no surprise that MileageWise comes out on top – our experience with the app was quite memorable. Also worthy of mention but not found here is Driversnote – a Danish company that focuses on the international market when it comes to mileage. These savvy Scandinavians offer a sleek app much like MileageWise’s; they even have Bluetooth auto-tracking available through an external USB hardware, called iBeacon. The only trouble is that you have to sign up for a year to enjoy the service.

Pricing and Free Versions

Most apps start out by offering you a free version, hoping to you entice you into purchasing a full version with your credit card. That’s nothing new, but it is important to understand how each provider does its free versions, because some, like Everlance, offer an eternally free version – it’s just that you can’t record more than 30 trips per month. MileageWise, on the other hand, gives you their full version to try out via a 14-day trial period. As with most things – if you want to know the specifics about the free offers each company puts forward, go to their website to find out more.

The prices themselves generally range from $5 to $15, with more features offered at each tier. It should be noted, however, that most companies display these monthly amounts in their pricing plans – yet the amounts shown assume that you sign up for a year.

What’s the Best for Small Businesses?

If you are an employee who drives a vehicle for business purposes for a small business, or, if you are a business owner – mileage reimbursement is an essential part of how you operate your business. Driving a vehicle for business is a large expense – intelligent business owners almost always provide their employees with a good reimbursement plan, usually favouring the federal mileage rate for work related activities that those workers undertake. Administratively, this can be a tedious and arduous process. This is because you need to keep track of the business mileage that everyone does, which, again, is best done with a mileage tracking app.

Many providers offer a teams dashboard for the submission of easy workflows which aggregate mileage and allow employers to pay it out in a timely manner. Coming back to MileageWise, they also offer a mileage log preparation service; something which is ideal if you run your own personal business and need to present all of your employees’ logs to the IRS pronto. This service does come with extra costs, though as any small business owner will tell you – staying up to date with mileage reimbursement is a crucial part of managing business expenses within your company.

The Long and Short of it

At the end of the day, our overview today has helped crystallize the reality of the situation: MileageWise offers the best of the features out there. Driversnote, MileIQ, TripLog and Everlance also offer great apps, but they have a few more pitfalls. As is often the case in today’s global economy, the rule of thumb is caveat emptor, or buyer beware. Pay attention to which of today’s best mileage tracker apps offer the most and do your own research – there are a lot of good choices out there.